FAQs

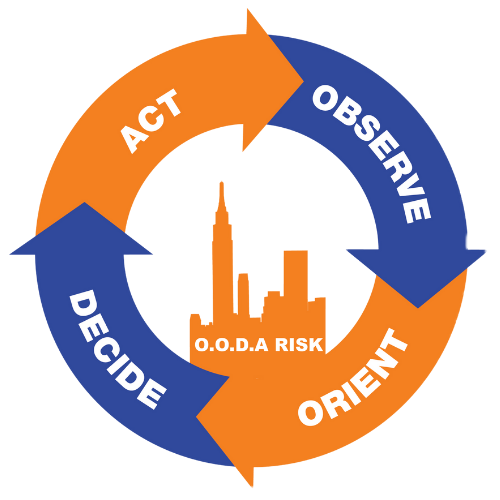

Today’s business environment is nothing short of war. OODA Risk is based upon the military concept developed by Col John Boyd during the Korean War. Col Boyd understood that having a tight feedback loop is critical to battle field success.

That collecting, understanding, then acting on critical risk based information is a major competitive advantage for those companies that have stop simply buying commercial insurance ; instead focusing on what drives the high cost of their insurance program; CLAIMS !

The OODA Risk feedback loop let’s our customers benchmark their future metrics off their historical data, allowing them to manage the hot spots in their organization before they become full on fires. You can’t manage what you don’t know.

Smart companies understand that investing in Risk Management has a positive return on Investment and is not a true expense.

In our over 30 years of experience assisting various organizations achieve best practice risk management techniques to prevent and mitigate their losses we noticed the following common threads.

- Lacked an organization wide system to collect, organize, and report critical risk based information.

- It took too much effort to assemble the data for management so that it had enough utility to drive proactive decision making that compressed their risk based cost, like insurance and retention levels.

- The data was not delivered timely; which is a critical variable that compresses costs.

- Without proper data and metrics centered around your risk based costs it was too difficult to hold all stakeholders accountable.

- Our Risk Management Information System (RMIS System) is a highly secure cloud based system that you can deploy throughout your entire organization to track the following information.

- Incident Intake System to track near misses and potential claims.

- Insurance Claims system to track the following claims information.

- Claim Numbers

- Date of Loss

- Claims financials such as reserves & payments

- Claims trend analysis

- By Causation

- By Shift

- By Location

- By Job Title

- By Body Part

- By Entity or Division

- By Direct Report Supervisor

- Insurance Policy Information

- By line of insurance

- By policy Effective Date & Expiration Date

- By Premium basis & cost structure

- Loss Pic Profitability by line of insurance or insurance carrier.

- Claims reported to the insurance carrier

- Retention levels

- Policy contacts

- People

- By job title

- By location

- By shift

- By tenure

- By training & Certification

- By incident or claims attributes

- Property

- By COPE ( Construction, Occupancy, Protection Class, Environment)

- By Location

- By Value

- By Vehicle

- Claims Attributes

- These is only a partial list of items you can track and maintain. Please check out our ODDA System Library to system features and case use studies.

- Fortunately for us the insurance brokerage industry single handedly created this niche industry. First off their commission based compensation structure is exactly contrary to your goals which is why they don’t perform these functions. As your claims rise, so does their compensation structure which is why they don’t provide the necessary resources. CLICK HERE for more on that.

- Quite often we discover huge gaps of insurance coverage in the program. Too many customers buy insurance on trust and have no way of proofing what they purchased. That’s a lot of risk to leave to chance.

- Many times we see clients are in insurance programs that are not efficiently structured. They started out as small mom & pop operations 20 years go with 10 employees. Now they have 200, 500, or 1000 employees and yet the insurance program is still structured as if they had 10 employees. Many times we can reduce your insurance costs by over 30% just by tweaking the retention limits. Customers aren’t leveraging their balance sheets and are buying too much insurance. The reason for this is the brokers commissions remain high if you don’t change how your program is structured.

- It’s ALOT of work to get comparison quotes. It’s noisy, inefficient and done improperly. We set up an RFP system so that all brokers are bidding on the same spec that we develop. We assign markets, set deadlines, parse each quote for coverage differences, selecting the best (2) for your review. Most companies don’t have the proper staffing in house to execute this effectively. Nor do they have the time bandwidth. We do, further we have the contacts.

- What larger companies understand; well designed and staffed Risk Management Departments break even at worst, usually deliver a positive ROI in the double digits.

- Building a Risk Management Division lowers yours COGS (cost of goods & services). Further, they better position your company to win more business at higher profit margins because they focus their efforts up and down your Profit & Loss Statement, not just the line item of general liability or work comp insurance.

- The majority of our accounts tend to be in industries that have high frictional costs. As an example the Real Estate industry suffers from high frequency events (trip & falls) that if managed improperly will drive the costs up of your insurance program. Construction, Home Healthcare, Elder Care, and Transportation are other industries that we cover because of the high employee injury rates that impact many GL codes on your profit & loss statements.

- Many of our processes and systems are industry agnostic. As an example our RIMIS system tracks incidents, claims, insurance policies, rates, and claims trends analysis irrespective of your industry. Where we do see significant differentiation is on the loss control / loss prevention component of our program. Here we tap specific 3rd party loss control engineers that cover your specific industry so you get industry specific insights and recommendations.

UNFAQs

- That’s a much longer discussion then this space allows, however many companies still process the claims as one off transactions instead of building a protocol that delivers consistent results over time. They use a PDF form & email. The better ones roll up the data points to an excel spreadsheet to aggregate the individual claims data points (pixels), until they pixelate and create a picture of what’s happening in the org.

- We provide a full on claims & incident reporting (near misses ) system that your team and ours can coordinate on. Without a RMIS system that invites various stakeholders to collaborate on, it’s very difficult to manage and compress your claims with enough consistency to impact the P&L. That’s just where we start. Then we execute an aggressive claims action plan to close the item out. The longer these stay open, the more expensive they become. Most companies lack the systems as well as the staffing that has the bandwidth (time) to close the claims out. There is so much more to our process on attacking the claims. Best to schedule a brief consult with your individual challenge.

- While we can’t fully answer that question here we can share with you (1) example of a data point that we think pays significant dividends; LAG TIME REPORTING. We measure several data points here.

- What’s the distance in time between when the incident occured & when the supervisor or Direct Report was notified?

- What’s the distance in time between when the Direct Report knew of the incident and when they reported into HR?

- What’s the distance in time between when management knew of the incident and when they reported it into our system?

By measuring the time intervals within your reporting matrix we can see if there is a breakdown in the communication chain. From start to finish a well run organization would have the incident into our system within hours so our claims team can then jump on it and guide your team as to next steps.

You can’t manage what you can’t measure. Our system manages hundreds of data points contingent on your industry and your challenge.

-

- Companies spend an inordinate amounts of money purchasing benchmark reports of their peers for comparison. We agree this can be valuable however with respect to Risk Management it’s our opinion that the best benchmark to use is yourself.

- When we on-board a Client we take an initial snapshot of their data at the beginning of an engagement. We then track risk expenses like legal fees, safety, insurance premium (rates), incurred claims e.t.c. and we convert these data points to a rate off your chosen benchmark. Below is an example of certain industries we cover and how they benchmark their results.

- Real Estate – Units (Doors) or Square Feet under management.

- Construction – Square feet built , hours worked, sales , payroll.

- Home Health Care – Customers

- Transportation – Power Units , Miles Driven. Hours Worked

The most important element of benchmarking is that you are actually doing this so you can get a read on the investment ROI your making in safety and risk management. The second most important element is that you are consistent in your measurements so you can get an accurate picture. Our OODA RISK system does this automatically for you so your staff isn’t spending time doing reports. They are deployed elsewhere in the organization to get you better results.