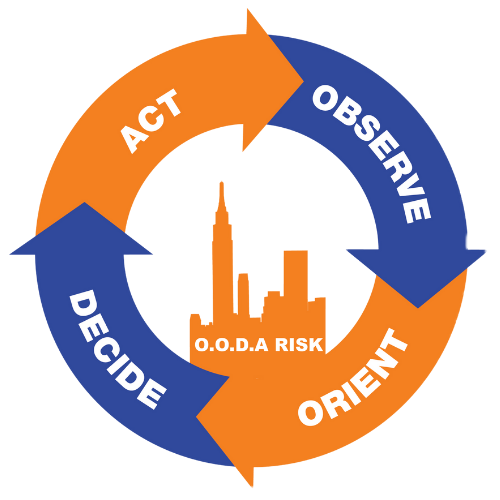

Observe

Orient

Decide

Act

All Your Claims Centralized In A Secure Cloud Based System

Your current team contains multiple insurance carriers, brokers, consultants, safety personnel , insurance adjusters, attorneys & members of your staff. Each team member working in isolation of each other until something occurs and then it becomes an endless string of email chains and shared documents.

OODA Risk allows your team to consolidate all of your incidents (near misses), claims, insurance policy information into one system.

What is OODA?

The OODA Risk feedback loop lets our customers benchmark their future metrics off their historical data, allowing them to manage the hot spots in their organization before they become full-on fires. You can’t manage what you don’t know.

Smart companies understand that investing in Risk Management has a positive return on investment and is not a true expense.

If you are tired of sending more of your profits to the insurance companies than to your bank account; consult with an OODA Risk Advisor today.

Why OODA?

It's a game-changer for your business

Well-run larger organizations understood with the early years of their growth that they needed to invest in a Risk Management platform for their company. They understood as they grew so did their claims, which then drove their insurance costs. To remain cost-efficient & cost consistent they knew they had to build systems and protocols to address their organization gaps. Which is why they “invested” in a Risk Management Department. They understood that a well-run Risk Management Department had a positive ROI, and was not a true expense.

How We Work

Our state-of-the-art OODA RISK Software is the nucleus of our entire program. It provides a system to submit incident data, claims data, track insurance policy information, tying it all back into one RMIS system, holding your team accountable, benchmarking your org, ultimately significantly lowering the cost of your insurance program.

Who We Serve

Claims Challenged Companies

Companies in the cohort are suffering from huge insurance renewals in (1) line of insurance or multiple lines of insurance. They know they can do better, however they don’t know where to start. It may be significant increases in your work comp costs due to employee injuries, or significant increases in your liability program due to a few large losses, or many small trip & fall nuisance claims. Don’t make your learning curve more expensive than it needs to be. We shorten the time it takes to right the ship, knowing time is money.

Companies with Outstanding Claims Results

Too often these companies have been buying insurance the same way when they were half the size they were years ago. Further, due to their outstanding operations and low claims experience they have generated significant profits for their insurance carriers, and commissions for their brokers.

We reveal to the companies in this cohort how much profit they generate for the insurance carriers. Then by restructuring their current insurance program we show them how they can share in those underwriting profits; often reducing their insurance expense loads by 45%, year after year.

There is a whole other parallel commercial marketplace many of the companies in this cohort have never been exposed to. Their previous brokerage relationships have never introduced them to these Alternative Market Products because they generate significantly less commissions.

Companies in Need of a “Full Service” Insurance & Risk Management Consultant

Managing, shopping your insurance program is a cumbersome, opaque process. Companies in this cohort have grown too large to execute this solely on their own. They often come away from the experience exhausted, with questionable results. We show companies how to build a repeatable process that is customized to their organization by opening up the black box both the carriers and the brokers don’t want you to see.

Click the above circles for more.