How We Work

Well run larger organizations understood with the early years of their growth that they needed to invest in a Risk Management platform for their company. They understood as they grew so did their claims, which then drove their insurance costs. To remain cost efficient & cost consistent they knew they had to build systems and protocols to address their organization gaps. Which is why they “invested” in a Risk Management Department. They understood that a well run Risk Management Department had a positive ROI, and was not a true expense.

In our over 30 years of experience assisting various organizations achieve best practice risk management techniques to prevent and mitigate their losses we noticed the following common threads. Lacked an organization wide system to collect, organize, and report critical risk based information.

It took too much effort to assemble the data for management so that it had enough utility to drive proactive decision making that compressed their risk based cost, like insurance and retention levels.

The data was not delivered timely; which is a critical variable that compresses costs.

Without proper data and metrics centered around your risk based costs it was too difficult to hold all stakeholders accountable. The only key risk indicator they had was the amount of premium spend centered around the cost of their insurance program.

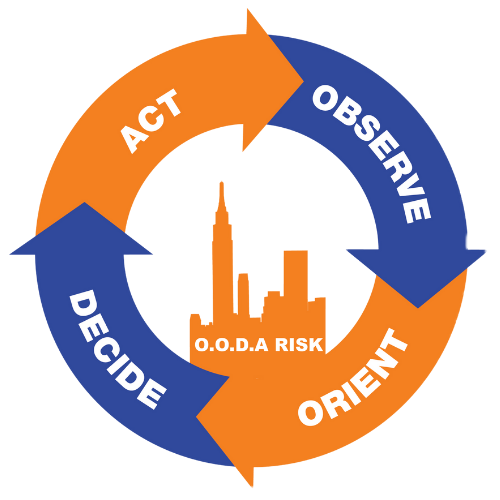

What OODA Risk Solves For:

In our over 30 years of experience assisting various organizations achieve best practice risk management techniques to prevent and mitigate their losses we noticed the following common threads.

Lacked an organization wide system to collect, organize, and report critical risk based information.

It took too much effort to assemble the data for management so that it had enough utility to drive proactive decision making that compressed their risk based cost, like insurance and retention levels.

The data was not delivered timely; which is a critical variable that compresses costs.

Without proper data and metrics centered around your risk based costs it was too difficult to hold all stakeholders accountable.

The only key risk indicator they had was the amount of premium spend centered around the cost of their insurance program.

- Our Risk Management Information System (RMIS System) is a highly secure cloud based system that you can deploy throughout your entire organization to track the following information.

- Incident Intake System to track near misses and potential claims.

- Insurance Claims system to track the following claims information.

- Claim Numbers

- Date of Loss

- Claims financials such as reserves & payments

- Claims trend analysis

By Causation

By Shift

By Location

By Job Title

By Body Part

By Entity or Division

By Direct Report Supervisor

- Insurance Policy Information

By line of insurance

By policy Effective Date & Expiration Date

By Premium basis & cost structure

Loss Pic Profitability by line of insurance or insurance carrier.

Claims reported to the insurance carrier

Retention levels

Policy contacts

- People

By job title

By location

By shift

By tenure

By training & Certification

By incident or claims attributes

- Property

By COPE ( Construction, Occupancy, Protection Class, Environment)

By Location

By Value

By Vehicle

Claims Attributes

- These is only a partial list of items you can track and maintain. Please check out our ODDA System Library to system features and case use studies.

The RMIS system noted above is the nucleus of the platform; providing a centralized depository to collect and organize information. However, without the proper staffing, acumen levels, and time band width an organization can never fully reap the benefits of the OODA Risk platform. That’s why we can augment most staffing short falls in a myriad of organizations.

If you look at the org chart of any risk management department around the country they typically include at a basic level:

- Risk Manager who is both strategist & tactician inside the organization. They are consider the risk architect as they design the assessment to stress test your org consistent with your perceived challenges both known & unknown. When the Risk Management Plan is complete they decide on what to measure , how often, benchmarking you against yourself. Most reverse engineer what success might look like inside your company and work backwards from there. They are the point person who handles whatever the project engagement is for our clients, managing all other member of the OODA Risk team in partnership with your point person.

- Claims Advocate : Our claims advocates were insurance carrier claims adjuster in their prior lives. They speak the adjusters language and understand how the game is played inside the carriers ivory tower.

Too many organizations lack the internal claims expertise and acumen which is why the insurance carriers claims adjuster are so successful in doble talking your staff.

Further their role is to coach up your staff to develop best practices with respect to incident reporting and claims management.

Lastly inside most org’s the internal HR staff does not have the band width to follow up continuously to close the claim out. We noticed in the over 10,000 claims we have closed over the years it takes an average of 48 touches to close the average work comp claim.

- Data Manager : This team member insures that all of your insurance policy and claims information is uploaded properly and representative of your current and historical data.

Safety & Loss Control Engineers : Contingent on the industry and expertise needed we tend to contract out for the exact background and expertise we need for your specific challenge. This enables us to draw from a very deep pre-qualified pool of loss control engineers that we can plug and play without the high cost of maintaining this talent inhouse which can be very expensive for our client base.

As An Example:

Industrial Physical Therapist : These folks build out very specific functional job descriptions to be used to make sure the people you hire can meet the physical demands of the job duties. Further these job descriptions are critical in building out a best practice alternative duty program.

- Post Loss Claims Engineers : If the potential claims dollars are large enough our 911 Protocol dictates that we dispatch our own loss engineers to conduct our own very through claims investigation to reserve and protect your rights. Understand the insurance carriers may have an entirely different agenda when evaluating a loss, both your carrier and theirs. Thoroughly documenting the loss up front for you, by you can save your organization much blood & treasure!

EXAMPLES OF THIS COHORT :

- Forensic Engineer: These are engineers, investigators and scientists who analyze a failure, perform necessary tests, and conduct research until we answer “how did this happen” and who is “responsible”. We think it’s critical this team member ONLY represents you!

This represents the basic core of our team. Each project is staffed according to the industry and the challenge considered.

Having been invited into thousands of businesses over the years a common thread of differentiation we see between companies that enjoy higher margins of profitability, greater market share are their operational protocols.

They execute the correct protocols with respect to safety ,claims, on-boarding and off-boarding of employees. They have excellent site, plant inspections and maintenance protocols.

We shorten your learning curve by sharing with you best practices of highly functioning orgs so your education isn't so expensive.