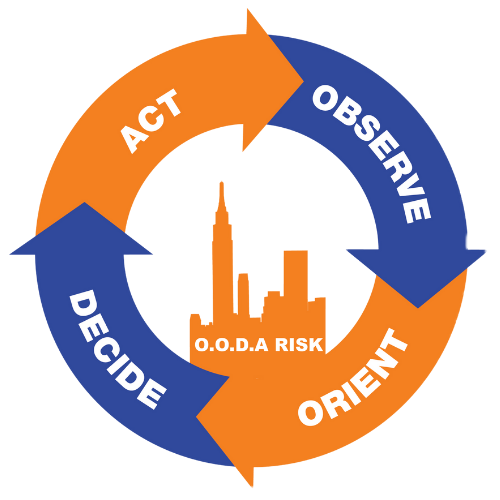

Our ability to win new projects is contingent not just on our quality and ability to deliver the project on time, but on budget as well. Our insurance cost, especially our FUTURE insurance costs really drive our new business pipeline.

Several years back NYC got hit with a rainstorm that dumped inches of rain in a short time. The building we were working on became flooded on all their A-line units. We notified OODA Risk through the mobile app, took pictures, established the location. Within hours they dispatched a forensic engineer and an attorney to the site. Having a turn-key emergency triage unit there helped us build a defense file for the litigation that we knew was headed our way.

Within months of reporting the claim, we were able to hand the loss back to the buildings insurance carrier because the claims team dispatched to the site established the buildings exterior drainage system was in woeful disrepair which proved to be both inadequate and the proximate cause of the loss. This ended up being a million-dollar claim event that would have devastated our insurance program cost structure for years had it not been for the OODA Risk Claims Team.

Our previous insurance consultant just analyzed our coverages and shopped the program on the street. The OODA Risk team focuses on transferring risk away from us, and managing the claims when they do hit which is far more valuable than just getting quotes. We understand that preventing and reducing claims to the secret sauce to maintaining great insurance rates, allowing us to win more business!

I am rarely in the office. 95% of what I do is from my smartphone. I input all of this information from my phone. It is very easy to use and the photo I sent was uploaded from a text. This is a great way to stay ahead of the curve and compile data. Great system

We were really suffering from the continuing escalation of our workers compensation costs. Our carrier kept paying workers comp claims, questioning little, paying a lot. We essentially lost control of our workers comp program as we were trying to run our business.

The OODA Risk team showed us their Comp Care System which was built for companies with our specific employee injury challenges. They came in, trained our staff on their day of loss (injury protocol). They built a time-efficient system around us using their software to record every incident that took place in our nursing home; allowing us to provide resources to the departments, the staff, and the specific training challenges we were having to prevent losses from happening in the first place. Best part is it took very little staff time to compile the reporting results.

They helped us build a return to work program and a safe patient care plan to obtain a 10% credit on our workers comp premiums. Then they aggressively attacked all our legacy claims as well as new claims coming into the system. In a very short period of time, they lowered our EMR ( Experience Modification Rate ) from a 1.30 to a .88. This was over a 42% decrease in our claims experience.

Further, they restructured our workers compensation program so that we could share in the significant profits we were generating for our previous work comp carrier, The New York State Insurance Fund. As of this writing, we have received over $719,916 in dividend payments since we restructured. To be clear; we are not in a Safety Group.

It was critical for us that our team had an outside voice, and outside resources to help us get out of our own way providing innovative leadership around our employee injury challenges. Their system and staff free up our people to focus on areas of concern internally while the OODA Risk team built the reporting framework we needed; giving us feedback to drive these kinds of results.

While we may have eventually gotten to a better place with our employee injury challenges, OODA Risk helped us get there far quicker, saving us much blood & treasure, which then allowed the OODA Risk Team to redesign our work comp program to better leverage our investment in safety and risk management, allowing us to re-capture a share of the underwriting profits.

“Prior to OODA Risk we had an “Insurance Consultant” who analyzed our policies and shopped our account out among their list of approved brokers to try and get better rates. Our success with this model was mixed at best.

OODA Risk identified the true cost drivers in our insurance program, built and deployed a custom risk management program for us, allowing us to restructure our insurance program. By changing our insurance structure, while remaining lender/investor compliant, we were able to reduce our commercial insurance expense by 40% while our peers had to continue to absorb 15 & 20% increase.

This would not have been possible had we continued to focus purely on shopping our insurance program through our prior consultant.”

Zara Case Study:

| Program Element | Prior To OODA RISK | After OODA Risk |

| 5 Year Loss Pic

(ratio of insurance premiums paid to Incurred loss) |

67% | 28% |

| Average Annual Premium Increase | 18%

(2019, 20,21) |

-40%

2021 |

| Return on Investment w Consultant | -38% | +423% |